A Personal Loan is a widely available credit facility in the current finance market that offers various benefits, contributing to its growing popularity. However, since it is an unsecured loan, lenders bear a high lending risk, leading them to impose strict eligibility criteria on borrowers.

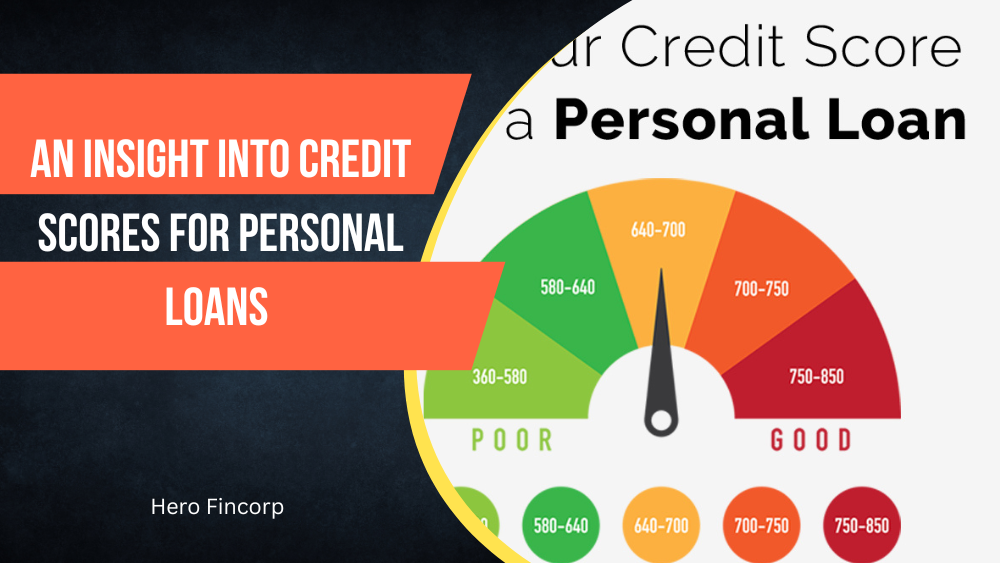

As a result, a vital role is played by CIBIL score in Personal Loan application process. It is a three-digit number that reflects the borrower’s creditworthiness. A higher score increases the likelihood of getting the desired loan amount, while a lower score may result in rejection or lower loan amounts. Additionally, even an average CIBIL score, typically ranging between 650-700, can bring additional benefits to the borrower.

What is the calculation method for the CIBIL score?

A good CIBIL score is important for anyone planning to take any loan. CIBIL is one of India’s leading credit rating agencies that assign this score by contemplating a few factors. These are –

· Repayment history

Repayment history is the most crucial factor for lenders to consider when assessing your creditworthiness. It reflects your past behaviour as a borrower, including whether you made timely payments and how often you defaulted. Clean repayment history is critical in determining your credit score.

· Credit utilisation ratio

The credit utilisation ratio is another factor that lenders review, and they prefer a low ratio. A high ratio indicates overdependence on credit, which may lead to financial instability in case of unforeseen situations. This factor negatively impacts your credit score.

· Current loans

Lenders also consider your current loans and review the type, amount, and duration of the loan repayment. This helps them evaluate your responsibility as a borrower.

By understanding how your CIBIL score is calculated, you can take steps to improve your creditworthiness before applying for a loan in Lucknow or anywhere else. The following tips may help:

How can you improve your CIBIL score?

Here are some ways to better your CIBIL score –

- Make sure you repay all your loans on time and don’t default on one

- Try to maintain the credit utilisation ratio below 30%.

- Refrain from applying for multiple loans at once.

- Maintain a healthy credit mix of secured and unsecured loans.

- Try not to close old credit cards.

Final words

While applying for a Personal Loan, you must see if your credit score suits them. If not, raise your score by focusing on the points mentioned above first. Then apply again. At the same time, compare the interest rates and other additional charges they may have and choose the loan offer that goes best with your financial objectives.